In 16+ countries across North America, Europe, Latin America and Asia, The Knot Worldwide champions the power of celebration. The company’s global family of brands provide best-in-class products, services and content to take celebration planning from inspiration to action. At the core of The Knot Worldwide business is our industry-leading global online wedding Vendor Marketplace, connecting couples with local wedding professionals and a comprehensive suite of personalized wedding websites, planning tools, invitations and registry services that make wedding planning easier for couples around the globe. Each year, The Knot Worldwide connects 4 million+ couples with nearly 850,000 vendors within its global wedding Marketplace.

Our purpose is to enable everyone to celebrate the moments that make us.

Our vision is to ensure everyone around the world is empowered to create celebrations that are authentic to them for the moments most important to them.

Nicole Aste is the Senior Vice President, Global Media Solutions at The Knot Worldwide. In this role, she is responsible for the company’s ad strategy and revenue growth. Nicole oversees national advertising sales, account management, integrated marketing and operations.

Nicole brings over 20 years of digital advertising experience and expertise. Prior to The Knot Worldwide, Nicole was VP of Revenue Operations for Conde Nast where she led sales planning, revenue operations, yield management and ad operations. Previously, Nicole held leadership roles at Tremor Media, Yahoo! and DoubleClick.

Nicole graduated cum laude from Mount Holyoke College with a Bachelor of Arts degree. She is based out of The Knot Worldwide’s New York City office.

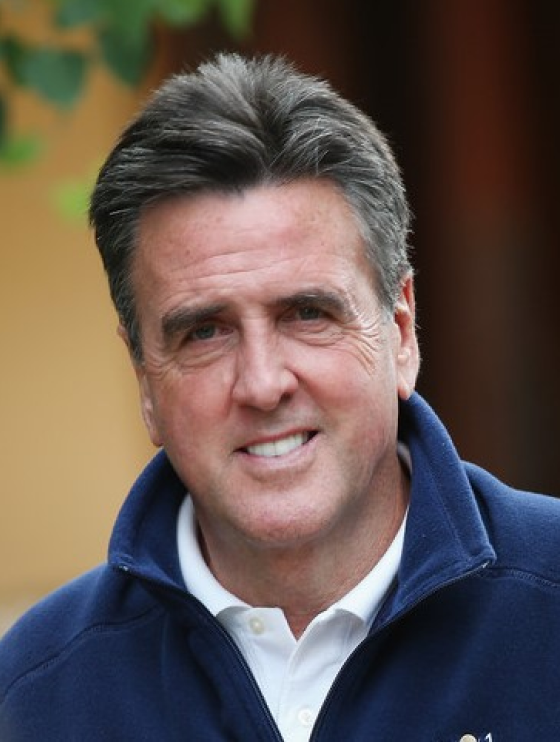

Ben Bates serves as the Senior Vice President of Strategy and Business Operations at The Knot Worldwide, responsible for strategy, development and business operations across the company’s portfolio of wedding brands in 14 international markets.

Prior to joining The Knot Worldwide, Ben spent 14 years at Booking.com where he served in a variety of regional leadership roles across both EMEA, North America and Latin America, working in the most critical and fastest growing regions for the business and reinforcing Booking.com’s position as one of the world’s leading digital travel companies.

Ben often guest lectures and mentors in university and business programs and is also passionate about supporting the start-up communities in both New York and London by coaching new entrepreneurs. While not at work or volunteering his time, Ben can be found enjoying time with his wife and two children.

George Bezerra is the Senior Vice President, Head of Data at The Knot Worldwide. In this role, George is responsible for leading the global Data team across Analytics, Data Engineering and Data Science. George has been in the data space for over 10 years and was previously VP of Data at Frontdoor, where he led the data engineering, machine learning, and data science teams. His past experience includes 5 years working at TripAdvisor where he built the data science and analytics functions and led the development of personalization algorithms in addition to computer vision and natural language processing models.

George holds a B.S. in Electrical Engineering and an M.S. in Computer Engineering from the Universidade Estadual de Campinas in São Paulo, Brazil, as well as a PhD in Computer Science from The University of New Mexico and postdoc at MIT. George resides in Denver with his wife and Havanese dog Panko.

Felicity Chaban serves as Chief Legal Officer of The Knot Worldwide and is responsible for all legal matters for the company’s global operations. Felicity has been with the company since 2015 and previously served as Senior Vice President, Legal, Deputy General Counsel and General Counsel.

Previously, Felicity served as Associate General Counsel for Blackboard Inc., a global education technology company. While at Blackboard, Felicity was responsible for advising on a wide range of legal matters including M&A, technology and strategic partnerships, marketing and real estate. Felicity also represented healthcare, technology and other clients in mergers and acquisitions as a corporate finance associate at Buchanan Ingersoll & Rooney PC in Philadelphia and Washington, DC.

Felicity holds a B.A. in economics from Boston College and received dual J.D. and M.B.A. degrees from Villanova University. Felicity also studied international law at the University of Notre Dame Law School in London. She is based out of The Knot Worldwide’s headquarters in Chevy Chase, MD, and lives in the Washington, DC area with her husband and three children.

Tim Chi is the Chief Executive Officer of The Knot Worldwide. After getting married in 2005, Tim set out to make wedding planning less stressful and frustrating. Together with his co-founders, Jeff, Lee, and Sonny, they threw four desks into his empty living room in Chevy Chase, Maryland and created WeddingWire, which became a leading global vendor marketplace serving the wedding industry, helping millions of engaged couples plan, execute and celebrate the most important day of their lives. WeddingWire grew to 1,000 employees worldwide and owned leading wedding brands in North America, Europe, South America and India. In 2019, Tim became CEO of The Knot Worldwide following the merger of XO Group Inc. (parent company of The Knot) and WeddingWire Inc.. Previously, Tim co-founded Blackboard Inc. in 1998. While at Blackboard, Tim pioneered many of Blackboard’s flagship products and strategic initiatives, bringing technology into the classrooms of colleges, universities and school districts across the world. During his tenure, the company raised over $100 million in capital and was taken public on the Nasdaq in 2004.

Tim holds a B.S. in operations research and industrial engineering from Cornell University and an M.S. in engineering management from Tufts University. He resides in Maryland with his family and is based out of The Knot Worldwide’s Chevy Chase headquarters.

Aryanne Ferranti is the Executive Vice President of North America Local and Global Support Operations. In her role, she oversees The Knot Worldwide’s US and Canada B2B wedding advertising marketplaces, driving revenue, go-to-market strategy, operations, training and enablement and billing and collections. She also leads the global support operations team in India and Ireland, which provide business insourcing to the company’s global, multi-channel businesses.

Prior to joining The Knot Worldwide in 2017, Aryanne led business strategy for the partner channel at Yext. Previously, Aryanne ran sales strategy and operations at Grovo Learning (now Cornerstone OnDemand) and global sales operations and enablement at TravelClick (now Amadeus Hospitality). Earlier in her career, Aryanne held roles at American Express and Barclays Capital.

Aryanne earned her B.A. in international relations from Wellesley College and her M.B.A. from Columbia Business School. Aryanne is based out of The Knot Worldwide’s NYC office and resides in lower Manhattan with her family.

Andy Ivanovich serves as Chief Financial Officer at The Knot Worldwide, responsible for planning and accelerating the company’s global growth. In this role, he oversees the accounting, finance, and corporate strategy functions of The Knot Worldwide.

Andy was formerly an investor at Spectrum Equity, where he worked with growth-stage software and internet companies, including WeddingWire. Prior to Spectrum, Andy was a senior consultant at Oliver Wyman FS, advising financial services clients across North America and Europe on transformational strategic initiatives. He previously spent time as an investor at Susquehanna Growth Equity and as a developer at a cellphone software startup.

Andy graduated magna cum laude from Cornell University with a B.S. in Operations Research and Engineering. He is based out of The Knot Worldwide’s headquarters in Chevy Chase, MD and resides in the Washington, DC area.

Jenny Lewis is the Chief Marketing Officer of The Knot Worldwide. In her role, Jennifer leads all Marketing, Insights, and Editorial initiatives for the company and its 19 global brands across 16 countries.

With expertise in scaling two-sided marketplaces and growing and advancing the visibility and impact of well-known brands, Jenny was the Head of US and Canada Marketing for Uber and UberEats prior to joining The Knot Worldwide. As one of Uber’s earliest marketing hires, she helped transform the start-up into an iconic household name, and was the driving force behind a number of product and brand-defining initiatives, including UberPOOL and the brand’s COVID-19 response campaign. Before Uber, Jenny worked at Undertone Advertising and Fox Networks Group (FX, National Geographic Channel, Fox Sports), where she developed co-marketing strategies with Fortune 500 brands such as MillerCoors and Volkswagen.

She is a graduate of George Washington University and currently resides in Boston with her family.

Jeremy Liebowitz is the Executive Vice President of eCommerce at The Knot Worldwide. In his role, Jeremy owns the global eCommerce P&L and leads the development and execution of the day-to-day and long-term growth strategy. He also oversees the Couple Experience team to provide best-in-class support to engaged couples planning and guests attending weddings.

Jeremy’s career has been rooted in eCommerce since its inception with experience in D2C and B2B eCommerce in over 50 categories, including apparel, technology, housewares, baby gear, writing, personal care and gifting. Prior to The Knot Worldwide, Jeremy co-founded Alchemy-Rx, a strategy, marketing and eCommerce agency. Jeremy also served as CEO for the Global eCommerce division of Newell Brands where he grew the division’s value from under $100M to over $2B globally. Prior, Jeremy led eCommerce for Jarden Corp, which was later acquired by Newell. Earlier in his career, he worked at 1800Flowers.com, Victoria’s Secret and Bath & Body Works.

Jeremy earned his Bachelor of Arts from USC in Los Angeles and is based out of The Knot Worldwide’s NYC office.

As Chief Revenue Officer, Angel drives the vendor marketplace growth strategy, scales the global sales organization and creates new advertising opportunities for small business wedding professionals and global partners. He also leads efforts to align strategy, operations and systems across The Knot Worldwide group’s 16+ global markets. Under his leadership, teams prioritize product innovation to support the more than 4 million yearly engaged couples and 840,000+ wedding professionals the company serves globally.

Prior to joining The Knot Worldwide, Angel was the Vice President and Managing Director for Asia-Pacific at Booking.com, where he was responsible for the business across the Asia and Oceania markets, leading operations, product and business development, and executing business strategy across one of the company’s fastest-growing regions. Angel joined Booking.com in 2012 and served in a variety of regional leadership roles including Senior Regional Director for North America and Regional Manager for Spain, Portugal, Africa and eastern Europe.

Previously, Angel served as CEO for IBB Hotels where he led strategy and business development and drove financial results for several companies within the group.

Angel graduated from Stanford Business School in strategy and business management, holds an MBA from IE Business School in Madrid and completed a Masters in hospitality and travel services management from EADA Business School in Barcelona. Angel often guest lectures in Masters and University programs and is fluent in Spanish, English, French and German. He is based in Barcelona, where he resides with his family.

Swapna Manne leads the Corporate Strategy team at The Knot Worldwide. In her role, she is responsible for working cross-functionally to identify and execute strategic growth and transformation opportunities for the company. Swapna has extensive experience in strategy, partnerships and corporate development across media, technology and consumer products. She has helped lead growth initiatives at large global brands like The Walt Disney Company as well as at venture-backed technology companies like Lulu.com and MaxPoint.

Prior to joining The Knot Worldwide, Swapna led the Strategy, Business Development and Analytics teams at Vericast, a marketing and advertising technology company within the McAndrews and Forbes portfolio.

Swapna holds a B.S. in business administration from the University of North Carolina at Chapel Hill and earned her MBA from The Wharton School at The University of Pennsylvania. Swapna is currently based out of Raleigh, NC where she lives with her husband, two children and treeing walker coonhound.

Emily Markmann is the Chief People Officer at The Knot Worldwide, responsible for the design and execution of Global Talent Strategy directly impacting company performance and business growth. Emily oversees all aspects of global human capital for 2,000+ employees across 16 countries. Emily drives a high-performing organization through innovative, culture-rich talent acquisition and talent management programs aligned with strategic corporate objectives.

Emily brings 25 years of experience in leading global, award-winning, progressive HR initiatives and strategic business operations at high-growth technology companies. Previously, as Senior Vice President of Talent & Culture at Clarabridge, she led talent acquisition, talent management and employee experience programs, domestic and international office expansions, and multiple M&A transactions. Emily also served as Vice President, Human Resources at Vangent and held various HR leadership positions at Appian and MicroStrategy.

Born in Argentina, Emily is native to Northern Virginia, and earned her Bachelor of Arts at Francis Marion University in South Carolina. Emily resides in Arlington, VA with her family and is based out of The Knot Worldwide’s headquarters in Chevy Chase, MD.

Nikita Miller serves as Senior Vice President, Head of Product Management at The Knot Worldwide. In this role, Nikita leads the global Product Management team, focusing on product strategy and growth, across all brands.

Nikita has spent her career in product management building great teams and creating products that users love. Most recently Nikita was VP Product at Dooly and prior to that she led product teams at Trello and Atlassian for 5 years. Nikita’s experience ranges from early stage startups to multinational companies; and from EdTech to Enterprise SaaS. Nikita is also an active startup advisor, angel investor and Board Member.

Nikita received her B.S. from Cornell University and her MBA from NYU Stern School of Business. She lives in upstate New York with her family.

Devin Nolan serves as Senior Vice President of Growth and Acquisition Marketing for The Knot Worldwide’s global businesses. In his role, Devin is responsible for driving B2C and B2B customer acquisition through paid marketing and organic channels (ASO and SEO).

Devin brings over 15 years of experience in growth marketing and digital advertising, having served in leadership roles at AOL Inc. as Vice President of Audience Development and Consumer Marketing and Senior Analyst positions at Advertising.com.

Devin earned his B.S. in marketing from Salisbury University and MBA from Loyola University Maryland. He is based out of The Knot Worldwide’s New York City office and resides in New Jersey with this family.

Matt Rook serves as Executive Vice President of Engineering at The Knot Worldwide. With more than 20 years of experience building B2B and B2C products, Matt is responsible for overseeing the global technology platforms that power both couple and vendor experiences across the company’s global brand portfolio.

Prior to The Knot Worldwide, Matt worked in both the finance and private startup spaces. Matt holds a BA from the University of Wisconsin, Madison and is based out of The Knot Worldwide’s New York City office.

Jennifer Thompson is Senior Vice President of Financial Planning and Analysis at The Knot Worldwide. Jennifer oversees global planning and analysis, the preparation and presentation of key business drivers and financial results, and provides data-driven insights and business decision support across the company. She is responsible for partnering with other company leadership to develop and implement financial business plans, strategic initiatives and operating priorities.

Prior to joining The Knot Worldwide in 2018, Jennifer served as a consultant at Blackboard and has previously held leadership roles in finance at organizations such as Transaction Network Services, RCN and Marriott International.

Jennifer earned her Bachelor of Arts degree in accounting and financial management from The Catholic University of America. She resides in northern Virginia with her family and is based out of The Knot Worldwide’s headquarters in Chevy Chase, MD.

Emma serves as Senior Vice President of Finance and Chief Accounting Officer at The Knot Worldwide, responsible for the company’s global accounting, accounting operations and financial reporting, compliance and tax groups.

Prior to joining The Knot Worldwide, Emma was an auditor in the Madrid and Washington, DC offices of KPMG where she provided assurance and audit services to large, multinational clients within the financial services, telecommunications and aviation sectors.

Emma holds a Bachelor of Arts Degree from Dublin City University and earned her MBA from EOI Business School in Madrid. She is also a Certified Public Accountant and a member of several international subsidiary boards within the TKWW global group. Emma is based out of The Knot Worldwide’s headquarters in Chevy Chase, MD, and resides in Silver Spring, MD with her husband and three children.

Zohar Yardeni serves as the Chief Product Officer at The Knot Worldwide. Zohar joined the company in August 2018 from Facebook, where he was a Product Manager leading several teams in the Local organization. Prior to Facebook, Zohar led the product, design, content and data teams as Chief Product Officer at Knewton and Vice President of Product at ZocDoc. Earlier in his career, Zohar ran several startups including CallStreet, an earnings call transcription service which he founded and subsequently sold to FactSet Research Systems (NYSE: FDS). Zohar also served as Global Head of Product Management at Thomson Reuters.

Zohar received a B.A. in philosophy and psychology from Cornell University and an M.B.A. from Columbia Business School. Zohar is based out of The Knot Worldwide New York City office and resides in Manhattan with his family.

Darren is the CEO and founder of BlackPines Capital Partners, a firm that helps owners and leaders of private and public companies materially improve the outcomes of their businesses through deep engagement, strategic realignment and best practice implementation. Darren Huston has been Chairman of The Knot Worldwide since 2017. He is also currently Chairman of Allegro Group, Skyscanner, and Operto.

Previously, Darren was CEO of Booking.com and Group CEO of the Priceline Group. He has over 30 years of managerial and leadership experience holding various executive positions with Microsoft (including CEO of Microsoft Japan), Starbucks, and McKinsey & Company.

Darren holds an MBA from Harvard University and an MA in Economics from the University of British Columbia. He and his family live in Vancouver, BC.

Tim Chi is the Chief Executive Officer of The Knot Worldwide. After getting married in 2005, Tim set out to make wedding planning less stressful and frustrating. Together with his co-founders, Jeff, Lee, and Sonny, they threw four desks into his empty living room in Chevy Chase, Maryland and created WeddingWire, which became a leading global vendor marketplace serving the wedding industry, helping millions of engaged couples plan, execute and celebrate the most important day of their lives. WeddingWire grew to 1,000 employees worldwide and owned leading wedding brands in North America, Europe, South America and India. In 2019, Tim became CEO of The Knot Worldwide following the merger of XO Group Inc. (parent company of The Knot) and WeddingWire Inc.

Previously, Tim co-founded Blackboard Inc. in 1998. While at Blackboard, Tim pioneered many of Blackboard’s flagship products and strategic initiatives, bringing technology into the classrooms of colleges, universities and school districts across the world. During his tenure, the company raised over $100 million in capital and was taken public on the Nasdaq in 2004.

Tim holds a B.S. in operations research and industrial engineering from Cornell University and an M.S. in engineering management from Tufts University. He resides in Maryland with his family and is based out of The Knot Worldwide’s Chevy Chase headquarters.

David Erlong is a Partner at Permira, primarily focused on investment opportunities in the Internet & Digital Media segment. He has worked on a number of transactions including Allegro, Boats Group, CommentSold, Flixbus, Minted, The Knot Worldwide, and Zwift. David is currently a Non-Executive Director at Allegro, The Knot Worldwide, Boats Group and CommentSold.

Prior to joining Permira, David worked at Investcorp, focusing primarily on opportunities in the Technology sector.

David holds a Master’s degree in Finance from EM Lyon Business School, France.

Thomas R. Evans is currently the Founder and Executive Chairman of Torticity LLC, a Florida-based legal services business. Thomas also serves as a director of Shutterstock, Inc. (NYSE: SSTK) since 2012, Angi (NASDAQ: ANGI) since February 2016, SmartAsset since 2016 and The Knot Worldwide since 2018.

From 2004 through 2013, Thomas was the President and Chief Executive Officer of Bankrate, Inc. (NYSE: RATE), an internet publisher of consumer financial content and rate information. Thomas served on Bankrate’s board of directors before retiring as Chief Executive Officer in 2013, and served as an advisor to the board of directors from 2014 to 2015. From 1999 to 2003, Thomas served as Chairman and Chief Executive Officer of Official Payments Corp. (NASDAQ: OPAY), an internet company specializing in processing consumer payments for government taxes, fees, and fines online. From March 1998 to June 1999, Thomas was President and Chief Executive Officer of GeoCities Inc. (NASDAQ: GCTY), a community of personal websites on the internet.

Prior, Thomas was a 20-year veteran of the magazine industry serving as President and Publisher of U.S. News & World Report (1991 to 1998), President of The Atlantic Monthly (1996 to 1998) and President and Publisher of Fast Company (1995 to 1998).

Thomas received a Bachelor of Science degree in Business Administration from Arizona State University. He resides with his family in Bronxville, New York.

Carolyn is a Senior Advisor at Permira, one of the world’s largest investment firms. Carolyn has over 28 years of experience in senior operating roles in consumer facing technology and media companies. She most recently was President of Instacart. Prior to Instacart, she was the Vice President, Global Business Group at Facebook (Meta) where she led a team of over 4,000 people in over 55 countries and was responsible for over $60B in revenue.

Prior to Facebook, Carolyn was the Corporate Vice President of Microsoft’s Global Advertising Sales and Trade Marketing Teams. Carolyn also spent seven years at Viacom and her last role was Chief Operating Officer of MTVN Ad Sales. Prior to Viacom, Carolyn held roles at Primedia, Walt Disney Imagineering and Accenture Consulting.

She currently serves on the boards of The Coca Cola Company, The Walt Disney Company, Under Armour, Villanova University, the Humane Society of the United States, Columbia Medical School and The Knot Worldwide. Carolyn is also a member of the Council on Foreign Relations, as well as a member of the 2017 Class of Henry Crown Fellows within the Aspen Global Leadership Network at the Aspen Institute.

Carolyn has been named to AdWeek’s “AdWeek 50” since 2013. In 2015, she was named to the top of Business Insider’s list of the Most Powerful Women in Advertising. Carolyn was twice included on Fortune’s “40 Under 40.”

Carolyn holds a bachelor’s degree in liberal arts and communications from Villanova University, from which she graduated Summa Cum Laude. She also obtained a master’s degree in business administration from Harvard Business School, where she was a Baker Scholar. Carolyn also received an honorary doctorate from Mount Saint Mary’s University. Her twins are second year college students at Yale and Duke where Carolyn serves on the Yale Parents Leadership Council and the Duke Parent Council.

Dipan is Partner and Global Head of the Consumer team at Permira where he serves on the Executive Committee and the Investment Committee. Dipan worked in the Technology team in London from 2009-2012 and then Menlo Park from 2012-2018. He now focuses on opportunities in the Consumer sector, working previously on a number of software and consumer Internet investments including Ancestry, Axiom, Informatica, LegalZoom, Renaissance Learning and The Knot Worldwide. He is currently a Non-Executive Director at Axiom, Boats Group, Catawiki, LegalZoom and The Knot Worldwide.

Prior to joining Permira, Dipan worked for Gores Group, a special situations private equity fund and earlier at Lehman Brothers. Dipan holds a degree in Economics from Cambridge University, England.

Kathleen Philips is a retired tech leader and active board member. She spent her career in leadership roles in technology companies in the San Francisco Bay Area and Seattle. Most recently, Katheen served as Chief Financial Officer and Chief Legal Officer at Zillow Group, where she previously had served as Chief Operating Officer and General Counsel. Kathleen also has served as General Counsel for a number of e-commerce companies including Hotwire, StubHub and FanSnap. She currently serves on the boards of Axiom Global, Accel Entertainment, Nerdy and The Knot Worldwide, and previously, at Apptio. Kathleen holds a B.A. in Political Science from the University of California, Berkeley and a J.D. from the University of Chicago. She resides in San Francisco, California.

Ben Spero joined Spectrum Equity in 2001 and is a Managing Director. His areas of investment focus include Internet-enabled software and information services. Prior to joining Spectrum, Ben worked at Bain & Company and co-founded TouchPak, Inc. He is Board Chair at Destination: Home, a public private partnership to end homelessness in Santa Clara County, and has served as a Board Director at The Knot Worldwide since 2018.

Ben received an AB, magna cum laude, from Duke University.

Email: careers@theknotww.com